FIRS Online Tax Clearance Certificate (TCC) Application: Your Complete Guide

After a company is duly incorporated by Corporate Affairs Commission (CAC) and Taxpayer Identity Number (TIN) issued by Federal Inland Revenue Service (FIRS), the next important statutory document is Tax Clearance Certificate (TCC). TCC is currently processed and obtained online. This guide will show you the steps to follow to apply and obtain your FIRS online Tax Clearance Certificate TCC for your new company. Especially if the company is not older than six months.

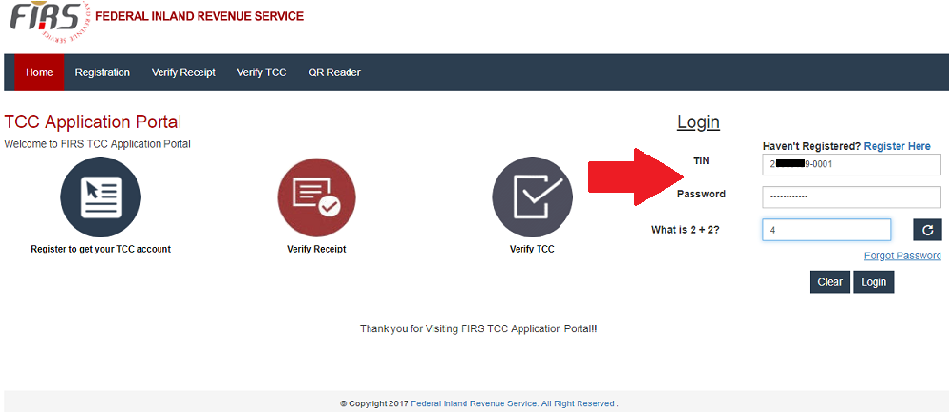

- Login into FIRS’ TCC Online Portal through tcc.firs.gov.ng. The link will take you to TCC Application Portal.

2. Click the registration icon indicated by red arrow above. After clicking, a pop-up window will show up. See the image below.

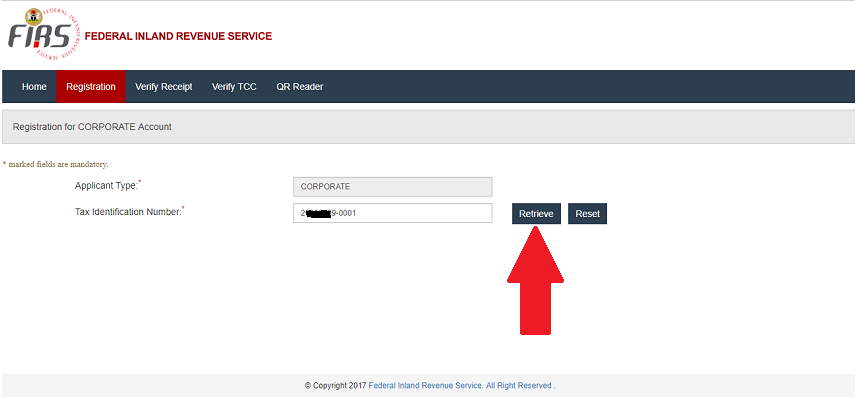

3. Click on “Corporate” icon as indicated by the red arrow above. This will take you to the account retrieval page. Type in your company TIN and click “Retrieve” as indicated by the red arrow below.

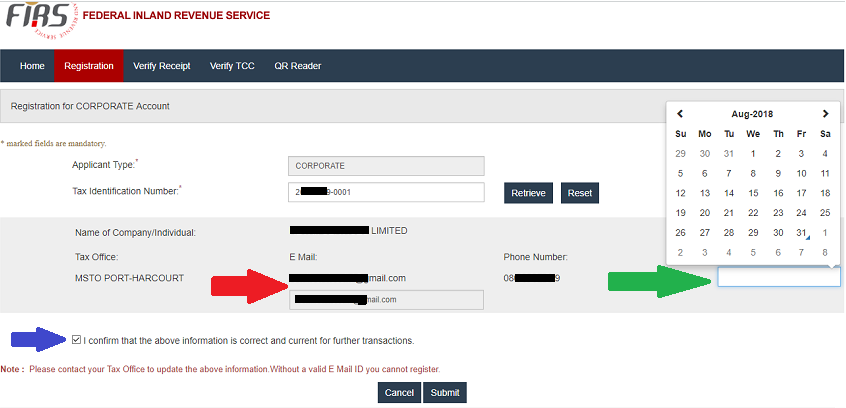

4. Your company’s detail will show up as shown below.

Check if your company’s detail is complete and correct. Make sure your company’s email is correct. If your detail especially your email is absent or incorrect or has a typographical error, go to step 5.

If everything is perfect, enter your company’s date of incorporation as indicated by the green arrow above. Check the confirmation box as indicated by the blue arrow and click submit. This will take you to a page with the message “Please check your mail to complete your registration” as shown below.

5. If you submitted successfully according to step 4, skip this step and move to step 6. If not continue reading. You will need to write a letter of “Request for File Update” on your company’s letter head. Submit it at the FIRS office where your company is domiciled. A sample of the letter is shown below.

A email will be sent to inform you when the update is done. If you don’t receive any email after some days, go ahead and login to TCC online portal and repeat the step 1 to 4 of this guide. Your detail should be updated by then, but if not you may need to follow-up on your letter.

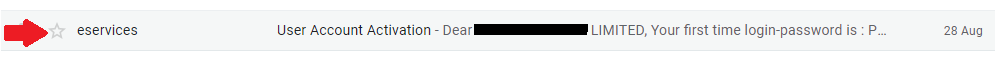

6. After you have successfully submitted your registration, check your email for “User Account activation” email.

The content of the email include “first time login password” and “activation link”. Click the activation link indicated by the red arrow below to activate your account.

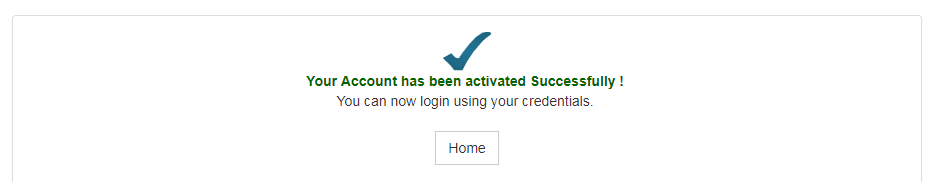

The page below will show up to confirm your account has been activated.

7. Click “Home” to take you back to TCC Application Portal.

Fill the login fields by the right as indicated by the red arrow above. Fill in your TIN and “first time login password” sent to your email. Fill the next field with answer to the addition of two numbers. Then click on login button.

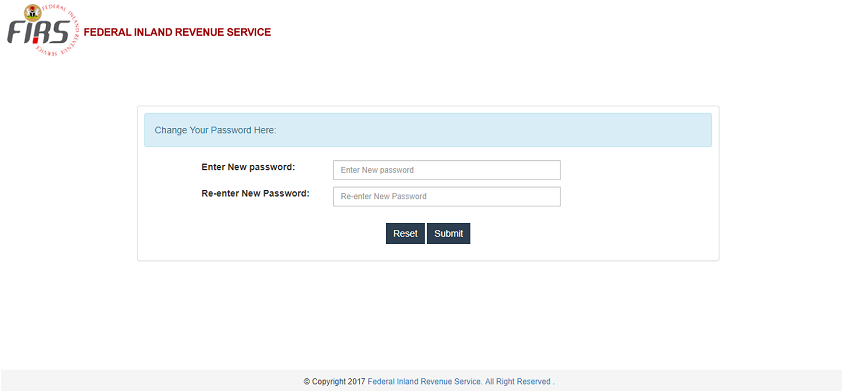

8. After your first login, you will be prompted to change your “first time login password”. Enter new password you can remember for subsequent login, then click submit.

This will open the Corporate Profile page below.

9. Scroll down to the bottom of the Corporate Profile page. Click the “Re-validation” button to re-validate your TIN as indicated by the red arrow below.

A pop-up window will come up. Click the check box to confirm information as indicated by the red arrow below. Then click “Update” button.

10. Under the “Profile Details” menu by the left of the Corporate Profile page, click on “Apply for TCC” menu.

11. This takes you to TCC application form. The application form is as shown below.

The form is not hard to fill. You can use the above sample as a guide. “Nature of Trade/Business” field is responsive. Enter a letter or word, and the field will provide you with a list to choose from as shown below:

Enter “0.00” in the “Turnover of the company in last 3 years in N” fields, since the company is new. Fill the remaining relevant fields. Check the check box to confirm the information you have provided is correct. Then click the “Submit” button. This will take you to a “Thank you” page, containing your application number as shown below. Keep your application number for future reference.

An email will also be sent to you to confirm your TCC application has been received.

12. Another “Update on TCC application” mail will be sent from FIRS 5 days or so after, to confirm your application is complete.

13. I am not sure of the ideal time frame for TCC to be ready from this point. But mine took six weeks and completely free. Within the period I visited FIRS MSTO office twice and their regional head office once for follow-up. After the sixth week, they sent me a “Status of TCC application” mail to inform me that my TCC had been approved. The same day they sent another mail, “TCC issued for application no. xxxxxxx” to inform me that my TTC had been issued. The TCC number and a download link were included.

14. Click on the download link which will take you to the TCC Application Portal. Login (as in step 7). In the Corporate Dashboard click on the “Download TCC” menu by the left.

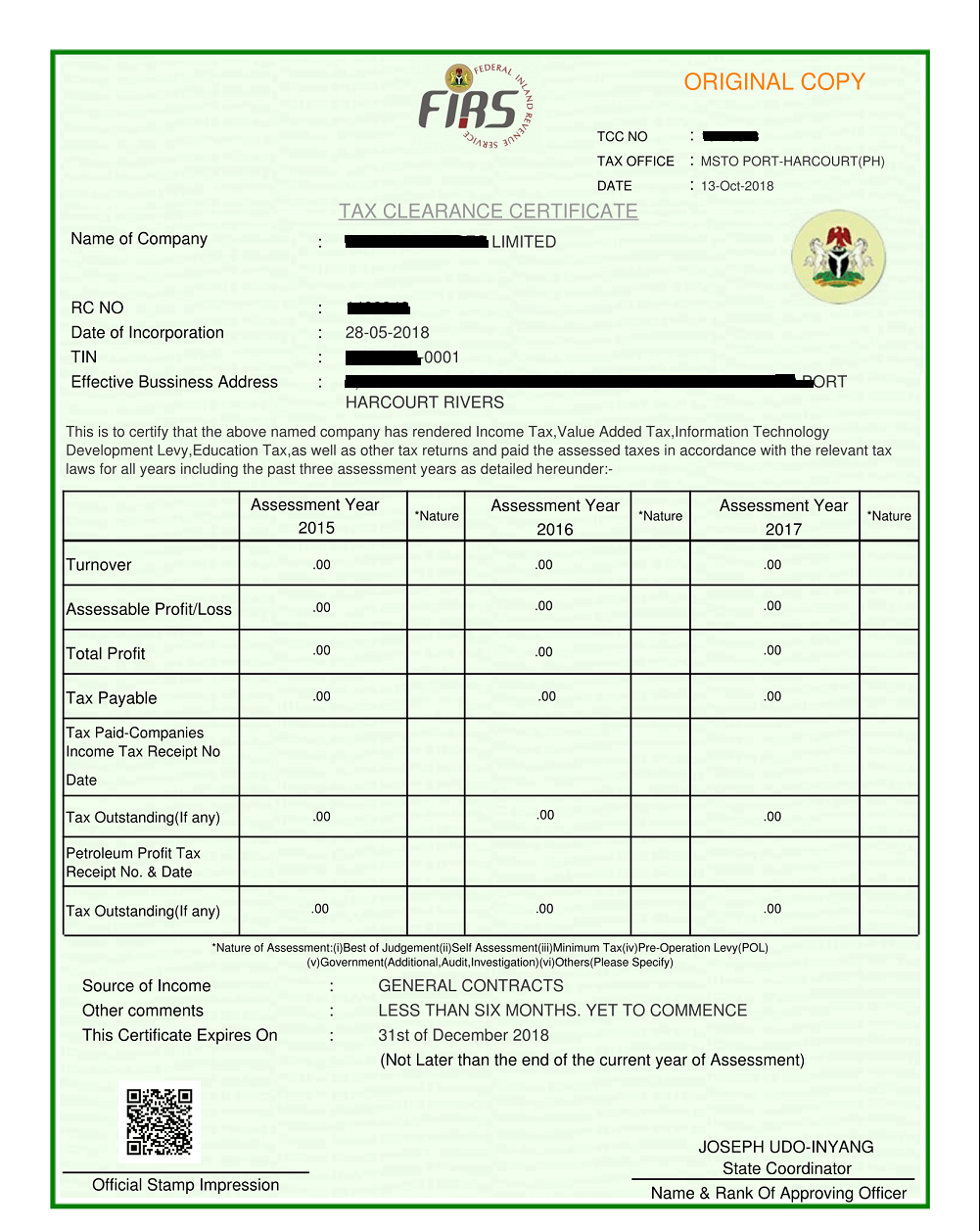

15. Enter your TCC mumber included in the “TCC issued for application no. xxxxxxx” mail sent to you. Click the “Download” button, and your TCC will be downloaded automatically into your computer. Check the download window of your computer. A copy of TCC is below.

I hope this guide on FIRS online Tax Clearance Certificate TCC application helps. If you need more clarifications or information please visit the FIRS online Resource Center.

A very simple step by step interesting procedure,highly enlighten and educative.

Thank you Nasir, I am glad you found the post helpful.

Type here..very succinct explanation. I am doing this right now. My request have reach them and an email have been sent to me in this regard with a reference number. Waiting for their next mail. Thanks

You are welcome. Good to know you found the post handy. Have a successful TCC application.

Hello, thanks alot for the detailed explanation.. I have received the link to download the TCC but it doesn’t display TCC homepage where I can access my Profile for download, instead it’s showing the application portal.. Please any suggestions? .. Thanks

Hi Promise, sorry it took me some time to reply. Login to your account through the application portal, and follow step 14 and 15 in this post. Thank you

Thanks a lot, it was really helpful I do appreciate.

You are welcome Onyedika. I’m glad the post was helpful.

pls i want to change some details such as email address on my account. How do i go abt it.

Hi Immaculate, please check Step 4 and 5 of the post, your answer is there. Let me know if you have futher questions.

Boss, that TIN retrieve is fetching any tin details now. Tried severally to no avail.

Hi Mr. B, I guess that should be a temporary system or server issue. Keep trying, but if the issue persists, you can visit your domicile FIRS office to lodge a complaint. Thank you

after filling the fields and submitting it , am getting error Message like “ERROR SOMETHING WENT WRONG1” why is it so please i need help

Hi Success, I guess that should be a temporary system or server issue. Keep trying, but if the issue persists, you can visit your domicile FIRS office to lodge a complaint. Thank you

Please improve on your services; the portal has been down for a long time, why?

There is the need to really do something about the server!

Thank you.

ISMAIL BELLO

MBT CONSULITNG

[email protected]

[email protected]

+2348036255660

Hi Ismail, this is a wrong place to lodge a complaint about FIRS portal or server. We are not in any way an affiliate of FIRS. If you face any challenge with FIRS portal please kindly lodge a complaint on FIRS website. Thank you